On April 8, 2013, the Milwaukee Journal Sentinel reported that the human resources manager for a major Milwaukee scrap recycling company had been charged with embezzling more than $1 million from the company over the previous 6 years. Eight days later, on April 16, 2013, the Milwaukee Journal Sentinel reported that a former secretary at the Shorewood School District had pled guilty to embezzling approximately $310,000 while serving as a secretary in the Special Education Department.

The circumstances surrounding these embezzlements 1 seem consistent with conclusions and statistics reported in recent research regarding embezzlement and occupational fraud.

Association of Certified Fraud Examiners 2022 Study

The Association of Certified Fraud Examiners 2022 Report to the Nations on Occupational Fraud and Abuse (The “ACFE 2022 Report”) was based on data compiled from a study of 2,110 cases of occupational fraud that occurred in the workplace between January 2020 and September 2021. This particular study is unique in that it explores frauds that were investigated during a global pandemic. As such, anti-fraud professionals were challenged to find new, innovative ways to conduct their work.

Cryptocurrency Schemes

With more organizations incorporating the use of cryptocurrency into their regular operations, individuals now have additional tools at their disposal to perpetrate fraud. While the ACFE 2022 Report identifies cryptocurrency in only 8% of the fraud cases in their study, there is evidence to suggest that this number will rise in future years. The most common fraud schemes utilizing cryptocurrency involved bribery and kickback payments (48%) or the conversion of misappropriated assets to cryptocurrency (43%).

The ACFE 2022 Report included the following statistics:

— The median loss caused by occupational fraud was 117,000 (USD). Small businesses (those with fewer than 100 employees) had the highest median loss of 150,000 (USD).

— 8% of fraud cases involved the use of cryptocurrency.

— More than 69% of frauds occurred in for-profit organizations, with 44% of the victim organizations being private companies and 25% being public companies. Private and public companies suffered a median loss of 120,000 (USD) and 118,000 (USD), respectively.

— Nonprofit organizations were the victims in only 9% of the reported fraud cases and suffered the smallest median loss of 60,000 (USD).

— Over half (52%) of the victim organizations do not recover any of the fraud-related losses.

— The size of the fraud loss is often related to the position that the fraud perpetrator holds. The median loss committed by owner/executives was 337,000 (USD), the median loss caused by managers was 125,000 (USD) and the median loss caused by employees was 50,000 (USD).

— Most occupational fraud perpetrators are first-time offenders with clean employment histories. Approximately 83% had never been punished or terminated for fraud-related conduct by previous employers.

— The typical occupational fraud scheme lasts 12 months before it is detected and causes a loss of 8,300 (USD) per month. The longer a fraud remains undetected, the greater the financial loss.

— Fraud is most commonly detected through employee tips (42%).

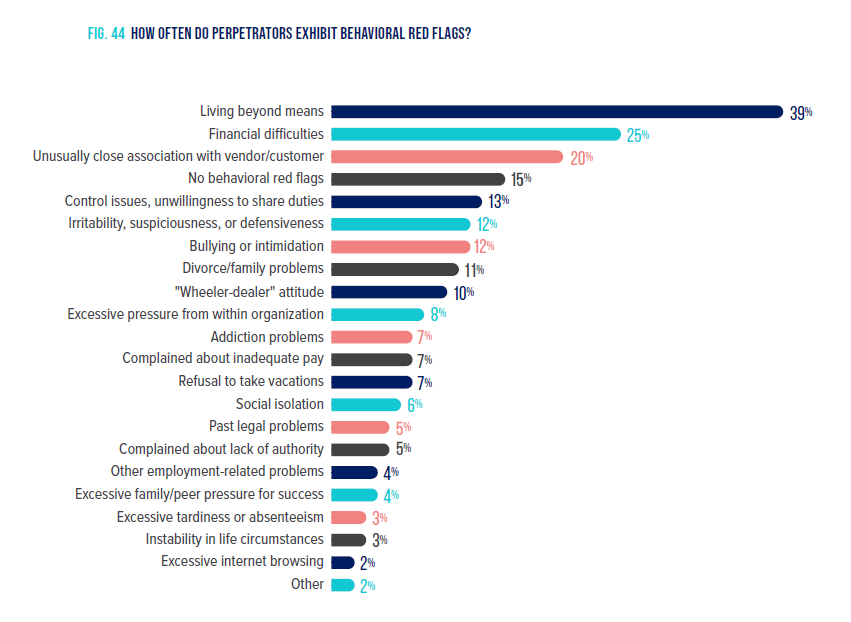

The vast majority (76%) of fraud perpetrators displayed behavioral red flags that are often associated with fraudulent conduct.

The most common red flags reported were:

- Living beyond means

- Financial difficulties

- Unusually close association with vendors or customers

- Excessive control issues or unwillingness to share duties

- Unusual irritability, suspiciousness, or defensiveness

- Bullying or intimidation

- Recent divorce or family problems

- A general “wheeler-dealer” attitude involving shrewd or unscrupulous behavior

The ACFE 2022 study concluded that organizations with anti-fraud controls in place experienced smaller fraud losses and detected frauds more quickly than organizations without anti-fraud controls.

Four anti-fraud controls in particular were associated with a 50% or greater reduction in both fraud losses and duration:

- A code of conduct

- An internal audit department

- Management’s certification of financial statements

- Regular management review of internal controls, processes, accounts, or transactions

While the presence of these mechanisms alone does not ensure that all fraud will be prevented, management’s commitment to and investment in targeted prevention and detection measures send a clear message to employees, vendors, customers, and others about the organization’s anti-fraud stance.

The 2022 ACFE Report identifies common characteristics of the perpetrators of occupational fraud:

• 54% of fraudsters were between the ages of 31 and 45 years old

• Fraudsters employed at their organizations for at least 10 years caused median losses of

250,000 (USD). This figure is 5 times the median loss caused by perpetrators with less

than 1 year of tenure• More than half of all occupational frauds came from the departments of Operations, Accounting, Executive/Upper Management or Sales

• Men were responsible for the perpetration of 73% of embezzlement schemes

• Men also caused a larger median loss (USD $125,000) than women (USD $100,000)

The Gender Gap is Closing

The gap in median losses between men and women in this study was much smaller than in previous ACFE research. Though median losses caused by men were only 25% higher than median losses caused by women, in each of the ACFE prior studies conducted since 1996, median losses caused by male perpetrators were at least 75% higher than median losses caused by female perpetrators.

Accounting 101

In both of the above from the Milwaukee Journal Sentinel and all of the embezzlement / fraud cases we have been involved in at The BERO Group, the common thread is something every accountant should have learned in accounting 101– when there is money flowing out of an entity, duties should be segregated.

1 Embezzlement is defined in most states as the theft of assets (money or property) by a person in a position of trust or responsibility over those assets.